Homeowners Insurance in and around Moorefield

Homeowners of Moorefield, State Farm has you covered

The most important parts of a home are the people you share it with... and the State Farm insurance that covers it.

Would you like to create a personalized homeowners quote?

Welcome Home, With State Farm Insurance

One of the most important actions you can take for your favorite people is to get homeowners insurance through State Farm. This way you can take it easy knowing that your home is taken care of.

Homeowners of Moorefield, State Farm has you covered

The most important parts of a home are the people you share it with... and the State Farm insurance that covers it.

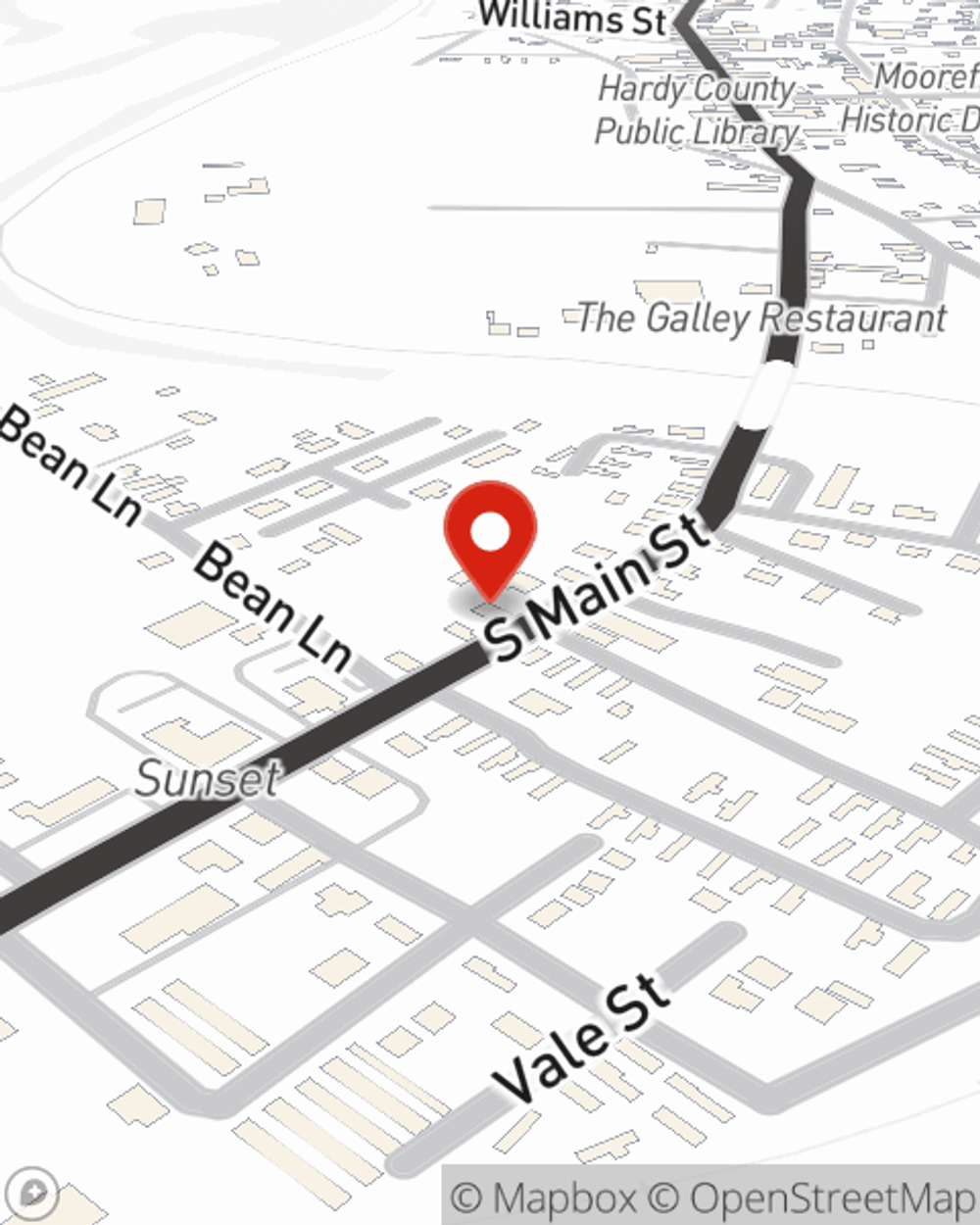

Agent Judy Ball, At Your Service

Judy Ball will help you feel right at home by getting you set up with high-quality insurance that fits your needs. State Farm's homeowners insurance not only covers the structure of your home, but can also protect treasured items like your grandfather clock.

When your Moorefield, WV, residence is insured by State Farm, even if something bad does happen, your most valuable asset may be protected! Call or go online now and see how State Farm agent Judy Ball can help meet your home insurance needs.

Have More Questions About Homeowners Insurance?

Call Judy at (304) 538-6166 or visit our FAQ page.

Protect your place from electrical fires

State Farm and Ting* can help you prevent electrical fires before they happen - for free.

Ting program only available to eligible State Farm Non-Tenant Homeowner policyholders

Explore Ting*The State Farm Ting program is currently unavailable in AK, DE, NC, SD and WY

Simple Insights®

Can a power surge damage my electronics?

Can a power surge damage my electronics?

Help prevent power surges from zapping your electronics and protect your property from electrical hazards by following these tips.

What are landlords responsible for? Learn before you move in

What are landlords responsible for? Learn before you move in

If something goes wrong in your apartment, you need to know how to proceed. Before signing a lease, know your landlord's maintenance responsibilities.

Simple Insights®

Can a power surge damage my electronics?

Can a power surge damage my electronics?

Help prevent power surges from zapping your electronics and protect your property from electrical hazards by following these tips.

What are landlords responsible for? Learn before you move in

What are landlords responsible for? Learn before you move in

If something goes wrong in your apartment, you need to know how to proceed. Before signing a lease, know your landlord's maintenance responsibilities.